21+ Mortgage down payment

Whats driving mortgage rates the week of Aug. The accelerated biweekly version will be higher at 59677.

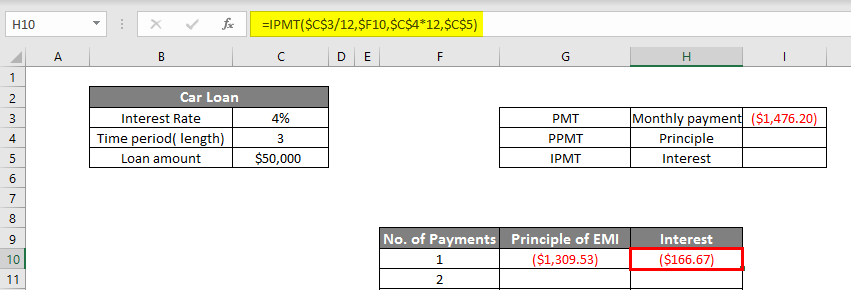

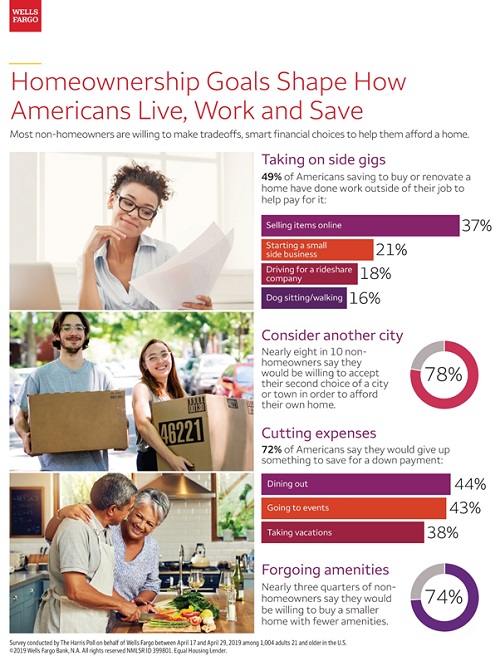

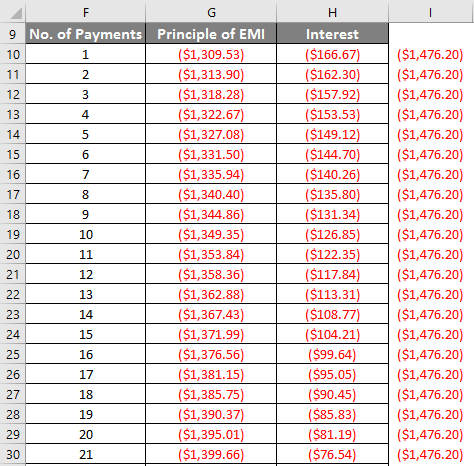

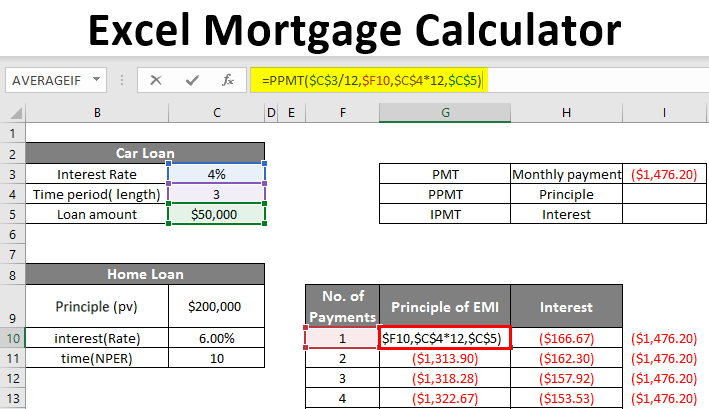

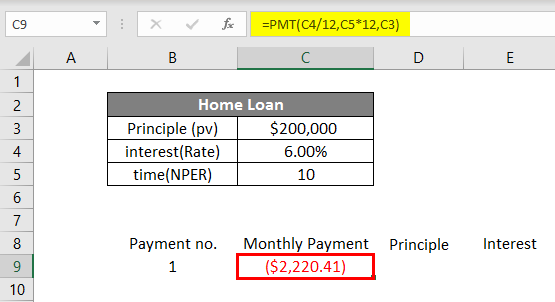

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

However most portfolio lenders allow you to borrow the down payment unlike conventional mortgage lenders.

. For instance if your monthly payment is 119354 its biweekly counterpart is 55086. Brian Davis on November 19 2019 at 321 PM Glad to hear it Dan and keep us posted on your progress. It also computes your total mortgage payment inclusive of property tax property insurance and PMI payments monthly PITI payments.

The first mortgage loan is a competitive 30-year fixed-rate government-insured loan FHAVA. That means you can use business credit lines and cards like Fund Grow helps you secure. If you want to pay down your mortgage early this is not a bad way to do it by making an extra payment.

In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage. An amortization schedule indicates the number of payments you should make to pay off your mortgage. 3 min read Aug 30 2022 Calendar.

Credit scores generally a minimum of 680 middle FICO score and above some. Fannie Mae HomePath mortgage. Assuming you have a 20 down payment 160000 your total mortgage on a 800000 home would be 640000.

A mortgage lender credit gives you a break on closing costs but it isnt free money. Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. 3 Down payment mortgages for first-time home buyers April 21 2022 Do bi-weekly mortgage programs pay your mortgage down faster.

If you pay half your monthly mortgage payment every 2 weeks that ends up being 52 weeks per year 2 weeks per payment 26 half-payments which is equal to 13 full payments. Learn the rules of mortgage down payment gifts like whats involved who can gift funds and how much money can be gifted. The accelerated amount is slightly higher than half of the monthly payment.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Suzanne De Vita. The NJHMFA Down Payment Assistance Program DPA provides 10000 for qualified first-time homebuyers to use as down payment and closing cost assistance when purchasing a home in New Jersey.

This program can only be used in 21 approved Florida Counties. Some conventional lenders will accept down payments as low as 3 but youll most likely need to purchase private mortgage insurance PMI to secure the loan. Dave P on November 26 2019 at 9.

21 2021 6 min read. Cherry Creek Mortgage was awarded one of the Top 100 Mortgage Company Awards for 2021 by Mortgage Executive Magazine. So for a 100000 mortgage youd need a down payment of 20000 excluding closing costs and taxes.

Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. This can be used for down payment Buyers mortgage closing costs or can also be used to split pay mortgage insurance premium to lower mortgage insurance cost or pay mortgage insurance completely off. The DPA must be paired with an NJHMFA first mortgage loan.

Low down payment. With each subsequent payment you pay more toward your balance. 3 Down payment mortgages for first-time home buyers April 21 2022 Do bi-weekly mortgage.

It breaks down how much of your payment is applied to the loans principal and interest. Lenders typically require a down payment of at least 20. I can tell you that there are still zero down mortgage options available in certain situations including for USDA and VA loans and widely available 3 and 35 down options as well.

In short you can still get a mortgage with a relatively small down payment assuming its owner-occupied and not a vacation home or investment property. The Chenoa Fund helps home buyers with down payment assistance worth 35 of the purchase price. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 2874 monthly payment.

The easiest way to avoid a down payment is to qualify for one of the two no-down payment mortgage programs.

Pmt Formula

1

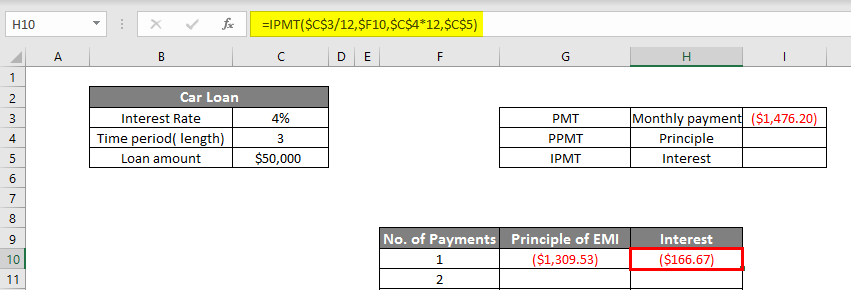

Potential Homeowners Will Work Two Jobs To Save Down Payment Mortgage Professional

Income Needed To Buy A House Can You Afford One Spendmenot

Jennifer Smith Owner Mortgage Loan Processor Rj Grey Mortgage Processing Llc Linkedin

News Michelle Perez Realtor Re Max Gold

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

21 Mortgage Statistics That Come As No Surprise In 2022

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

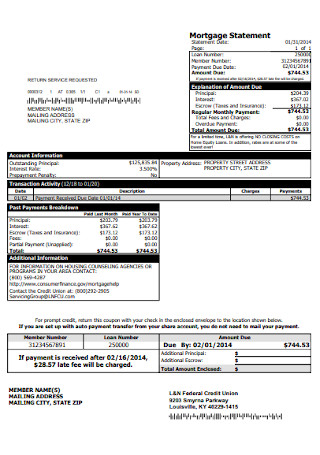

21 Sample Mortgage Statement Templates In Pdf Ms Word

Sad But True Rising House Prices Remax Sound Properties Facebook

1

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Century 21 Ag Realty Group Facebook

1

News Michelle Perez Realtor Re Max Gold

21 Mortgage Statistics That Come As No Surprise In 2022